How to Write a Letter of Cancellation for a Pay Order or Demand Draft from a Bank

Introduction

In today’s fast-paced financial world, it’s not uncommon for individuals or businesses to require the cancellation of a pay order or demand draft from a bank. Whether due to a change in plans, an error in the initial request, or any other reason, knowing the proper steps to take in canceling these financial instruments is essential. In this guide, we’ll walk you through the process of writing a letter of cancellation for a pay order or demand draft from a bank, ensuring clarity and efficiency in your communication.

Understanding Pay Orders and Demand Drafts

Before delving into the cancellation process, it’s crucial to understand what pay orders and demand drafts are. Both are forms of financial instruments issued by banks, often used for secure and guaranteed payments.

- Pay Order: A pay order is a pre-paid instrument issued by a bank, instructing another branch of the same bank to pay a specified sum of money to the payee.

- Demand Draft: Similar to a pay order, a demand draft is a negotiable instrument used for transferring money. However, unlike a pay order, a demand draft is drawn on one bank and payable at another, making it more versatile for transactions.

Reasons for Cancellation – Cancellation Pay order

Various circumstances may necessitate the cancellation of a pay order or demand draft. Some common reasons include:

- Change in Plans: Plans can change abruptly, leading to the need to cancel a payment.

- Error in Details: Mistakes in the details of the instrument, such as the amount or payee’s name, require cancellation and reissuance.

- Lost or Stolen Instrument: If a pay order or demand draft is lost or stolen, cancellation is necessary to prevent unauthorized use.

- Disputes or Inaccuracies: Disputes or inaccuracies in the transaction may prompt cancellation for resolution.

Writing the Letter of Cancellation Pay order

When drafting a letter of cancellation for a pay order or demand draft, clarity, and accuracy are paramount. Here’s a step-by-step guide on how to compose the letter effectively:

Heading

Include the bank’s name, address, and contact information at the beginning of the letter.

Date

Below the heading, write the date on which the letter is being written.

Recipient Information

Address the letter to the appropriate department or individual responsible for processing cancellations.

Subject

Clearly state the purpose of the letter in the subject line, e.g., “Request for Cancellation of Pay Order/Demand Draft.”

Salutation

Begin the letter with a formal salutation, such as “Dear Sir/Madam” or the recipient’s name if known.

Body

In the body of the letter, provide the following details:

- Account Holder Information: Your full name, account number, and contact details.

- Instrument Details: Specify the details of the pay order or demand draft to be canceled, including the instrument number, date of issue, and amount.

- Reason for Cancellation: Clearly state the reason for the cancellation, keeping the explanation concise and factual.

- Instructions for Processing: Request the bank to process the cancellation and provide any necessary instructions for refund or reissuance.

Closing

Conclude the letter with a polite closing, such as “Yours faithfully” or “Sincerely,” followed by your signature and printed name.

Sample Letter Format – Cancellation Pay order

[Date]

[Bank Name]

[Bank Address]

[City, State, Zip Code]

[Bank Contact Information]

Subject: Request for Cancellation of Pay Order/Demand Draft

Dear [Recipient Name/Department],

I, [Your Full Name], holding account number [Your Account Number] with your esteemed bank, am writing this letter to request the cancellation of a pay order/demand draft issued by me.

Details of the instrument to be canceled are as follows:

- Instrument Number: [Instrument Number]

- Date of Issue: [Date of Issue]

- Amount: [Amount]

The reason for cancellation is [Reason for Cancellation]. I kindly request your prompt attention to this matter and the necessary processing of the cancellation. Please advise on any further steps required and the timeline for refund or reissuance.

Thank you for your attention to this request. Should you require any additional information, please don't hesitate to contact me at [Your Contact Number] or [Your Email Address].

Yours faithfully,

[Your Signature (if sending by mail)]

[Your Printed Name]

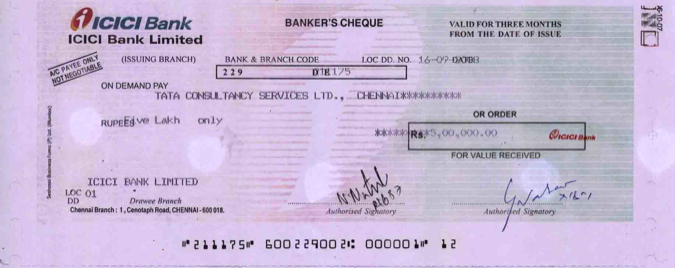

Features of a Demand Draft:Cancellation Pay order

- Pre-paid Nature: A demand draft is pre-paid, indicating that the drawee bank commits to paying the specified amount to the drawer upon presentation of the instrument.

- Specific Payee: Demand drafts are payable only at a designated branch or center of the bank and cannot be cashed elsewhere. This information is clearly stated on the demand draft itself.

- Validity Period: A demand draft remains valid for three months from the date of issue. After this period, it becomes invalid, and a new demand draft must be drawn if the payment is still required.

- Assurance of Payment: Since a demand draft can only be drawn against sufficient funds in the drawer’s account, there is an assurance of payment upon presentation of the instrument.

- Legal Framework: Disputes or conflicts related to demand drafts can be addressed under the Negotiable Instruments Act, 1881, providing a legal framework for resolution.

Cancellation of Demand Draft:Cancellation Pay order

If the need arises to cancel a demand draft, the process typically involves visiting the issuing bank and making a formal request for cancellation. Here’s how it works:

- If the demand draft was purchased with cash, the original demand draft along with the cash receipt must be presented for cancellation. A nominal fee may be deducted, usually around 50 rupees, before the remaining amount is refunded in cash.

- If the demand draft was acquired through a cheque, simply presenting the demand draft to the bank suffices. The amount will be credited back to the account after deducting applicable charges.

Steps to Making a Demand Draft:Cancellation Pay order

- Request Form: Obtain the demand draft request form from your bank branch.

- Fill out the Form: Complete the form with all relevant details, including the beneficiary’s name, account number, bank details, date, and signature.

- Verification: Present the filled form to the bank cashier for verification and stamping. The cashier will assess your signatures and account balance before proceeding.

- Approval and Payment: After verification, the demand draft is processed, and a nominal fee is charged for the service. Once paid, you can collect the completed demand draft.

Expiry of Demand Draft:Cancellation Pay order

If a demand draft remains unredeemed or uncanceled beyond its three-month validity period, the amount does not automatically revert to the drawer’s account. Instead, the drawee must submit a request to the bank for re-validation. Upon verification, the bank re-validates the demand draft, enabling the owner to transfer the funds back to their account.

Frequently Asked Questions (FAQs) about Demand Drafts:

Q.What is a demand draft?

A demand draft, often abbreviated as DD, is a negotiable instrument used for withdrawing money from a bank. It functions as a prepaid payment method where the drawee bank commits to paying the specified amount to the drawer upon presentation of the instrument.

Q.How does a demand draft differ from a check?

Unlike a check, which can be cashed by the bearer, a demand draft is payable only to the specified beneficiary and can only be encashed at the designated branch or center of the issuing bank.

Q.What are the typical scenarios for using a demand draft?

Demand drafts are commonly used in situations where transactions with checks may be problematic or risky, such as making payments for large transactions, fees for educational institutions, or purchases involving parties who prefer the security of a prepaid instrument.

Q.How long is a demand draft valid for?

A demand draft remains valid for a period of three months from the date of issue. If the draft is not redeemed or canceled within this period, the amount does not automatically revert to the drawer’s account.

Q. Can a demand draft be canceled?

Yes, a demand draft can be canceled, but the process typically involves visiting the issuing bank and making a formal request for cancellation. The specific procedure may vary depending on whether the demand draft was purchased with cash or through a check.

Q. What happens if a demand draft expires?

If a demand draft expires without being redeemed or canceled, the amount does not automatically return to the drawer’s account. Instead, the drawee must request re-validation from the bank, after which the funds can be transferred back to the account.

Q. Are there any legal provisions governing demand drafts?

Yes, disputes or conflicts related to demand drafts are governed by the Negotiable Instruments Act, 1881, which provides a legal framework for addressing issues arising from demand draft transactions.

Q. What are the steps involved in making a demand draft?

The process of making a demand draft typically involves requesting a form from the bank, filling out the required details, submitting the form for verification, and paying the applicable fee. Once approved, the completed demand draft can be collected from the bank.

Q. Can demand drafts be used for international transactions?

Yes, demand drafts can be used for international transactions, but they may not be the most efficient method due to processing times and fees. Other options such as wire transfers or international money orders may be more suitable for such transactions.

Q. Is there a limit on the amount that can be drawn using a demand draft?

Banks may impose limits on the maximum amount that can be drawn using a demand draft, depending on their internal policies and regulations. Customers should inquire with their bank regarding any applicable limits before initiating a demand draft transaction.

Author Note:

By Noor Siddiqui, Founder of etaxdial.com

This article is written with the aim of assisting individuals in simplifying their lives by providing guidance on drafting sample letters. At etaxdial.com, our mission is to empower people with knowledge and resources to navigate various aspects of life with ease.

The information presented here is intended to offer practical tips and advice on writing effective letters, particularly in scenarios such as cancellation of pay orders or demand drafts from banks. It is our hope that readers find this article helpful in their endeavors to communicate effectively and efficiently in various situations.

Thank you for trusting etaxdial.com as your resource for simplifying life’s complexities.

#CancellationLetter#Banking#FinancialCancellation#DemandDraftCancellation#PayOrderCancellation#BankingTips#FinanceAdvice#CancellationProcess#BankingGuide#FinancialLiteracy

![Credit Score Check [CIBIL] by noor siddiqui from etaxdial.com](https://www.etaxdial.com/wp-content/uploads/2024/02/credit-score-check-cibil-by-noor-siddiqui-from-etaxdial-150x150.png)